Saturday, 26 April 2014

[7207] SUCCESS

【前風變壓器】【SUCCESS】

公司的背景:(Company's Background)

公司成立于1980年,也是马来西亚之一的最大低压变压器和工业照明灯设备制造商。

公司供的低压变压器产品在马来西亚是最全面的。还有提供大量的工业照明灯在国内和国际市场。

公司生产变压器和工业电源产品,如自动稳压器,电力线调节器,节能流明稳压器,高强度放电(HID)镇流器,电池充电器和测试人员。我们也做工业照明产品,如泛光灯,工矿和街道照明灯。

公司目前拥有超过850经销商在马来西亚。该公司开始通过提供,维修和配套的国内市场,也取得长足的进展在国际市场上。现在出口到40多个国家,包括法 国,澳大利亚,阿拉伯联合酋长国(阿联酋) ,日本,韩国,印度,香港香港和新加坡。公司进军全球市场将继续快速和有效地推进。

对环境的普遍担忧使未来与能源效率和可再生能源产品,为公司的首要任务。目标是继续研究和开发这些产品。同时,公司将被定位为电气工业设备与广泛的内部制造能力,已建立的制造商。新技术的发展将被纳入公司的生产流程和客户服务,以尽可能有效和高效越好。

公司打算在主场以巩固我们的地位与卓越品质的产品可靠的制造商,并在海外加强公司的市场地位。公司的目标是成为一个可靠的,动态的和重要的竞争者,无论是在马来西亚及海外以产品质量和客户满意度的承诺。

2005年头才上市在大马交易所的主板。代表公司上市在主板快要十年了。2015年1月19日,最高交易价在RM1.28。快接近十年后的今天(2014 年4月25日),股价收市在RM1.58。代表比上主板的第一天只高出30sen(没把股息和其他分红算在内)。如果以总回酬来算(把股息和其他分红算在 内),回酬大概是一倍。

SUCCESS was established in 1980 and now is one of the largest low-voltage transformer and industrial lighting manufacturers in Malaysia.

Company provide the most comprehensive range of low voltage transformers in Malaysia and also supply a large volume of industrial lighting to both domestic and international markets.

Manufactures transformers and industrial power products such as automatic voltage stabilisers, power line conditioners, energy-saving lumens regulators, high intensity discharge (HID) ballasts, battery chargers and testers. We also make industrial lighting products such as floodlights, highbay and street lighting.

The company has over 850 distributors in Malaysia. Has began by supplying, servicing and supporting domestic markets but have since made considerable headway in the international market and now export to over 40 countries including France, Australia, the United Arab Emirates (UAE), Japan, Korea, India, Hong Kong and Singapore. Our expansion into global markets will continue to advance rapidly and effectively.

Universal concerns over the environment have made coming up with energy efficient and renewable energy products a priority for the company. It is the company objective to continue researching and developing these products. Meanwhile, the company will be positioned as an established manufacturer of electrical industrial equipment with extensive in-house manufacturing capabilities. New technological developments will be incorporated into the manufacturing processes and customer service in order to be as efficient and effective as possible.

It is the company intention to consolidate our position at home as a reliable manufacturer with superior quality products, and to intensify our market presence overseas. SUCCESS aim to become a reliable, dynamic and important player both in Malaysia and overseas with a commitment to product quality and customer satisfaction.

SUCCESS has listed to main board of Malaysia's stock market exchange in early of year 2005. This represent for almost 10 years history. During its listing on 19-Jan-2005, the price price was peaked at RM1.28. For almost 10 years listing, the stock price finally broke its peak to reach RM1.58 on 25-Apr-204. This represent of 30sen higher than its first listing's highest share price (without considering of bonus and dividend along the years). By holding the share since from first day of listing, the return is merely one fold after consider of bonus and dividend returns.

部分投资者对公司的负面看法:(Negative Perception on The Company)

1)管理层不够积极 - 如果有细心跟踪公司在大马交易所公布的公告,可以发觉公司一路来都很积极地通过收购仔公司为经销这条路程来扑未来之路。也许公司一路来都很低调,而导致公司给部分投资者的一个坏印象。

2)低股息 - 表面上,我是同意的。但是一间以成长为主的公司,派发比较低的股息是可以体谅的。接下来的2014年5月19日,也是公司历史以来派发最高股息的一次,4sen。别忘了,公司曾经在2006年给红股,2011年也派出库存股,来回报小股。

3)沉闷的股价 - 笔者刚出道的时期,曾经投资过此公司。那时给我的感觉是一间很沉闷的公司。股价温水煮青蛙的那样感觉。就是如此,间接觉得公司对小股的照顾没什么样。

这个股给我的印象中,很多散户都赔了钱。长期投资他的回酬也不怎么样好!投资其实是一道很奥秘的学问。在某些时期,看起来很不错的公司,但是投资起来的回 酬就是不怎么样好。也许这就是时机的关系吧!笔者这次投资他,是以背离部分投资者的看法来跟他碰个运气,也不一定是对的。个人的其中一个投资方法就是喜欢 做人不喜欢做的事!只要觉得赔钱的风险几率不大(就算亏也不会很多)就可以去马了!

1) Management is not aggressive - If you really pay attention to the company announcement in the bursa website, you will notice there are many acquisition/incorporation of new subsidiaries news announced by the company from time to time. For me, it is a aggressive way for the company to make its future path with better return. I guess the bad perception on the company is due to low profile habit from the company and also investor do not really get sufficient information in deep about the company.

公司的背景:(Company's Background)

公司成立于1980年,也是马来西亚之一的最大低压变压器和工业照明灯设备制造商。

公司供的低压变压器产品在马来西亚是最全面的。还有提供大量的工业照明灯在国内和国际市场。

公司生产变压器和工业电源产品,如自动稳压器,电力线调节器,节能流明稳压器,高强度放电(HID)镇流器,电池充电器和测试人员。我们也做工业照明产品,如泛光灯,工矿和街道照明灯。

公司目前拥有超过850经销商在马来西亚。该公司开始通过提供,维修和配套的国内市场,也取得长足的进展在国际市场上。现在出口到40多个国家,包括法 国,澳大利亚,阿拉伯联合酋长国(阿联酋) ,日本,韩国,印度,香港香港和新加坡。公司进军全球市场将继续快速和有效地推进。

对环境的普遍担忧使未来与能源效率和可再生能源产品,为公司的首要任务。目标是继续研究和开发这些产品。同时,公司将被定位为电气工业设备与广泛的内部制造能力,已建立的制造商。新技术的发展将被纳入公司的生产流程和客户服务,以尽可能有效和高效越好。

公司打算在主场以巩固我们的地位与卓越品质的产品可靠的制造商,并在海外加强公司的市场地位。公司的目标是成为一个可靠的,动态的和重要的竞争者,无论是在马来西亚及海外以产品质量和客户满意度的承诺。

2005年头才上市在大马交易所的主板。代表公司上市在主板快要十年了。2015年1月19日,最高交易价在RM1.28。快接近十年后的今天(2014 年4月25日),股价收市在RM1.58。代表比上主板的第一天只高出30sen(没把股息和其他分红算在内)。如果以总回酬来算(把股息和其他分红算在 内),回酬大概是一倍。

SUCCESS was established in 1980 and now is one of the largest low-voltage transformer and industrial lighting manufacturers in Malaysia.

Company provide the most comprehensive range of low voltage transformers in Malaysia and also supply a large volume of industrial lighting to both domestic and international markets.

Manufactures transformers and industrial power products such as automatic voltage stabilisers, power line conditioners, energy-saving lumens regulators, high intensity discharge (HID) ballasts, battery chargers and testers. We also make industrial lighting products such as floodlights, highbay and street lighting.

The company has over 850 distributors in Malaysia. Has began by supplying, servicing and supporting domestic markets but have since made considerable headway in the international market and now export to over 40 countries including France, Australia, the United Arab Emirates (UAE), Japan, Korea, India, Hong Kong and Singapore. Our expansion into global markets will continue to advance rapidly and effectively.

Universal concerns over the environment have made coming up with energy efficient and renewable energy products a priority for the company. It is the company objective to continue researching and developing these products. Meanwhile, the company will be positioned as an established manufacturer of electrical industrial equipment with extensive in-house manufacturing capabilities. New technological developments will be incorporated into the manufacturing processes and customer service in order to be as efficient and effective as possible.

It is the company intention to consolidate our position at home as a reliable manufacturer with superior quality products, and to intensify our market presence overseas. SUCCESS aim to become a reliable, dynamic and important player both in Malaysia and overseas with a commitment to product quality and customer satisfaction.

SUCCESS has listed to main board of Malaysia's stock market exchange in early of year 2005. This represent for almost 10 years history. During its listing on 19-Jan-2005, the price price was peaked at RM1.28. For almost 10 years listing, the stock price finally broke its peak to reach RM1.58 on 25-Apr-204. This represent of 30sen higher than its first listing's highest share price (without considering of bonus and dividend along the years). By holding the share since from first day of listing, the return is merely one fold after consider of bonus and dividend returns.

部分投资者对公司的负面看法:(Negative Perception on The Company)

1)管理层不够积极 - 如果有细心跟踪公司在大马交易所公布的公告,可以发觉公司一路来都很积极地通过收购仔公司为经销这条路程来扑未来之路。也许公司一路来都很低调,而导致公司给部分投资者的一个坏印象。

2)低股息 - 表面上,我是同意的。但是一间以成长为主的公司,派发比较低的股息是可以体谅的。接下来的2014年5月19日,也是公司历史以来派发最高股息的一次,4sen。别忘了,公司曾经在2006年给红股,2011年也派出库存股,来回报小股。

3)沉闷的股价 - 笔者刚出道的时期,曾经投资过此公司。那时给我的感觉是一间很沉闷的公司。股价温水煮青蛙的那样感觉。就是如此,间接觉得公司对小股的照顾没什么样。

这个股给我的印象中,很多散户都赔了钱。长期投资他的回酬也不怎么样好!投资其实是一道很奥秘的学问。在某些时期,看起来很不错的公司,但是投资起来的回 酬就是不怎么样好。也许这就是时机的关系吧!笔者这次投资他,是以背离部分投资者的看法来跟他碰个运气,也不一定是对的。个人的其中一个投资方法就是喜欢 做人不喜欢做的事!只要觉得赔钱的风险几率不大(就算亏也不会很多)就可以去马了!

1) Management is not aggressive - If you really pay attention to the company announcement in the bursa website, you will notice there are many acquisition/incorporation of new subsidiaries news announced by the company from time to time. For me, it is a aggressive way for the company to make its future path with better return. I guess the bad perception on the company is due to low profile habit from the company and also investor do not really get sufficient information in deep about the company.

2) Low dividend payout - From a very brief glance on the company, I also certain to agree on this. Anyhow, the company is approaching the growth path as the main objective. Thus, it is acceptable for low dividend payout in the past. There will be 4sen dividend going to be ex-date on 19-May-2014 and it is the highest payout (in sen) in the history of dividend payout. Be remind that the company have also paid bonus share in year 2006 and distributed treasury share in year 2011 as well.

3) Boring stock price - Author did invested on this stock in the past. I really felt the share price movement was boring and annoying. It just like a frog inside slow boiling water which the share price will kill you slowly and deadly. This is one of the reason caused me felt the company is not treating minority shareholder in good way (as the share price is not moving up at all!)

From my past perception, I knew there are quite a number of local retail investors lost their money and time in this stock. Even you hold it for long term, the return is not really impressive at all! Stock investment is not just a direct question as like mathematics question. But it come with some hidden messages for you to make a guess and make the investment interesting. Timing to get involve into certain stock is important as well. Sometime, I like to make decision against local retailers' will to invest on a company and just try my luck by doing that. As long as I feel the risk for the investment in low (even if I judge wrongly, the loss is limited), I will just make it without hesitation.

主要看好的重点:(Main Points To Invest)

1)拥有连续成长10年的公司,但是股价又不怎么样的表现。

2)低估(RM1.58,EPS=25sen,PE=6.32),股息开始有增加的现象。

3)拥有SEB仔公司的65%股权。SEB预测能从Pengerang油田发展计划中得益。期待SEB稳健成长的业绩和其股价走动的效应。

4)亮眼的年复合增长率。

》十年收入的成长率 CAGR 17.92% (2013 @ 322,929 vs 2004 @ 62,105)

》十年税后盈利的成长率 CAGR 33.74%(2013 @ 28,934 vs 2004 @ 1,580)

5)预测成长能继续。(注意参考2013年3月买地来发展的公告)

。。。等等。。。

1) 10 years continuous growth record but its share price performance does not impressive at all yet.

2) Undervalued (RM1.58, EPS=25sen, PE=6.32) and started to show some indication on higher dividend payout.

3) The company has 65% of share in subsidiary, SEB, which is a listed company as well. Foresee the O&G expansion activity at Pengerang, Johor will contribute positively to SEB. Looking good on the SEB's growth and also its share price movement side effect to SUCCESS.

4) Impressive Compound Annual Growth Rate (CAGR)

》10 years Revenue CAGR 17.92% (2013 @ 322,929 vs 2004 @ 62,105)

》10 years PAT CAGR 33.74%(2013 @ 28,934 vs 2004 @ 1,580)

5) Foresee its growth will able to sustain well. (Pay attention to Mar-2013's land acquisition announcement)

...etc...

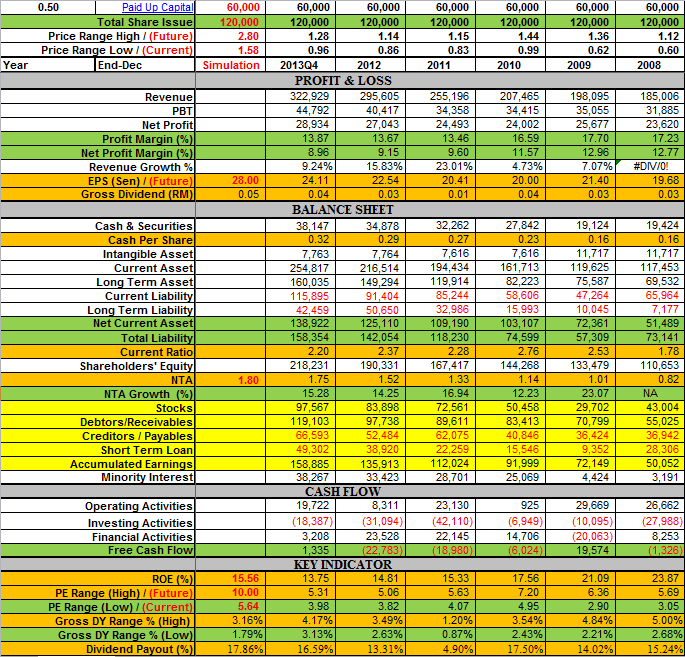

基本分析:(Fundamental Analysis)

|

| 10 Years P&L Trend |

|

| 5 Years FA Trend |

技术分析:(Technical Analysis)

|

| Monthly Chart |

|

| Daily Chart |

No comments:

Post a Comment