Sunday, 27 April 2014

Since it acquired Focal Aims's shares at RM1.40 per share in Sep last year, Eco World's share price has appreciated more than 5-fold, from less than RM1 to more than RM5.

I didn't buy Eco World's shares as I don't know how much it can earn in the future, even though I'm quite sure that it will reach SP Setia's current level in the future. However, how many years will it take? Is it worth to park my money here for many years?

Now here comes some clues.

As expected, Eco World has made a few major corporate exercises which will propel it to be one of the largest property developer "overnight".

In summary, Eco World Bhd proposed to acquire the development rights to 8 projects and the shares of a company with development land from the subsidiaries of its private company Eco World Sdn Bhd.

Before this, the listed part of Eco World only has one on-going project at Kota Masai township with 991.6 acres remaining, which was inherited from Focal Aims. The other project EcoSanctuary at Kota Kemuning, which was recently acquired from Tropicana, is only expected to be launched in 2015.

After the proposed acquisition, Eco World's total landbank will increase from 1,326 acres to 4,433 acres, while total GDV will increase almost 3-fold from RM13.5bil to RM43.5bil.

The table below shows Eco World Bhd & Eco World Sdn Bhd's landbank, in which all are in the property hotspots of Klang Valley, Iskandar Johor and Penang.

Eco World has already launched EcoSky (GDV RM970mil) and EcoBotanic (GDV RM3.79bil) in the fourth quarter of last year. It plans to launch all its other projects except EcoMacalister between 2014-2015.

It sets a sales target of RM2bil in 2014 and RM3bil in 2015. It has achieved sales of RM1.13bil as at 31 Mac 2014 from the two projects launched last year.

Eco World plans to launched another 6 projects shortly within the 3rd and 4th quarter of this year. They are EcoMajestic, EcoSpring, Eco Business Park I & II, EcoTropics and EcoTerraces.

EcoMajestic at Semenyih which has 1,073 acres land will be Eco World's largest township development at the moment. Inevitably this makes me link it to the success of Setia Alam by SP Setia.

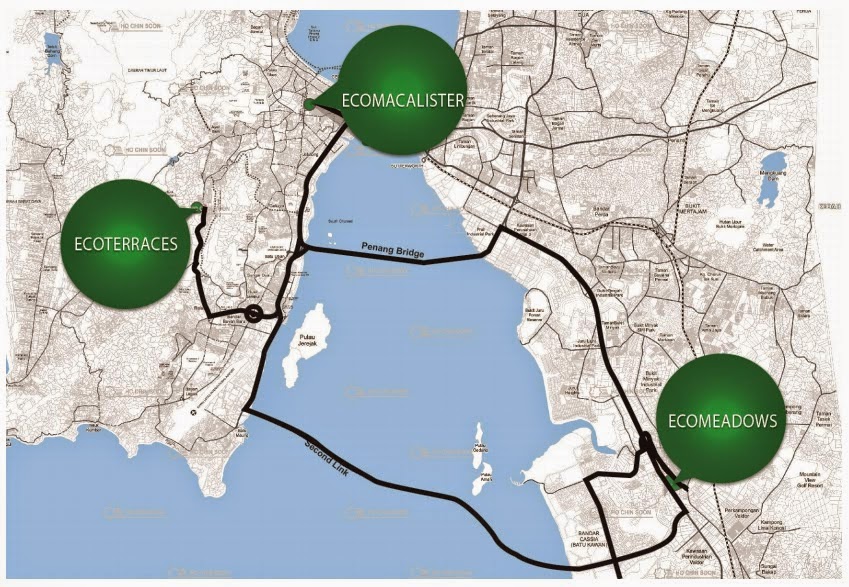

The maps below show the location Eco World's projects.

Eco World In Penang

Eco World In Klang Valley

Eco World In Iskandar Johor

To fund all these acquisition, Eco World will pay Eco World Sdn Bhd's shareholders (EW Holdings & Sinarmas Harta) in the form of Eco World's shares (shares subscription), as well as proposing rights issue with free warrants and then a 20% private placement.

Currently Eco World has total paid-up shares of 253.3mil, with par value RM1.

First, it will carry out share split of 1 into 2 ordinary shares, to total 506.6mil shares with par value of 50sen each.

Then EW Holdings and Sinarmas harta will subscribe to 403.4mil new Eco World's shares each, for RM1.70 per share, thus increasing the total paid up shares to 1,371.64mil.

After the share subscription, the public will only hold 13.48% (from 34.95%) of Eco World's shares, which will not be compliant to listing requirement of at least 25% shares in public hands.

Because of this, EcoWorld has proposed rights issue with free warrants and then 20% private placement.

The proposed rights issue with free warrants will raise approximately RM788mil before full exercise of the warrants. The number and pricing of the rights share are yet to be determined, but the price is expected to be fixed at not less than 20% discount!

After the rights issue, Ecoworld will carry out placement of shares up to 20% to investors to be identified later.

Below is the estimated paid-up shares after all the corporate exercises are completed. The number of shares after the share subscription is confirmed. After that, all are just base on assumption only.

In the calculation above, the proposed rights issue is assumed to be 1 rights to 2 ordinary shares at RM1.20 each, and 4 warrants for every 5 rights shares with exercise price of RM1.97 for warrants.

Even before any warrants are converted into shares, Eco World's total paid up shares already surges to 2.364 billion, about 4.6 times more than its total shares now after share split.

So the earning will be diluted by 4.6x (if the assumption on rights issue is true) and the GDV will increase by 3x.

How "BIG" will Eco World be after all the proposed corporate exercises completed?

We know that Eco World will have 4,433 acres of land with total GDV of RM43.5bil after this. Lets compare with other major developers in Malaysia.

The table below is obtained from CIMB analyst report dated 31 March 2014.

In term of landbank, Eco world with 4,433 acres will become the third largest land owner in the list behind UEM Sunrise & SP Setia. In term of GDV of RM43.5bil, it will still be quite a distance behind UEM Sunrise, Tropicana & SP Setia.

What should be the fair value for Eco World's share price?

Eco World's share closed at RM5.40 last weekend. Is it worth to buy now?

If the share split happens now, the price will be adjusted to RM2.70. Remember that the share subscription is fixed at RM1.70 per share, while the rights issue price is assumed to be only RM1.20 after at least 20% discount.

After the proposed rights issue and placement are completed, the total paid up shares are assumed to jump to 2,364 million (exclude warrants conversion).

If the fair value is RM2.70 (or RM5.40 before split) given a PE ratio of 15x, the EPS should be 18sen. For total shares of 2,364mil, its profit attributed to shareholders needs to be RM425mil.

Can Eco World achieve RM425mil annual net profit in the next few years?

Below are the FY13 results & latest PE ratio of other major developers.

| FY13 RM | Rev (bil) | PATAMI (mil) | PE |

| UEMS | 3.43 | 579.1 | 18.4 |

| SPSetia | 3.06 | 417.8 | 17.9 |

| Tropicana | 1.48 | 362.3 | 6.0 |

| Mahsing | 2.00 | 280.6 | 11.6 |

After comparing to the others, do you think RM400mil annual net profit is achievable for Eco World, given its target sales of RM5bil in the next 2 years?

I'm not sure. What I only know is that its projects will sell very very well.

If Eco World can get about 15% net profit like SP Setia, then it will be RM750mil net profit from the RM5bil sales but this should be divided into 3-4 years.

I don't think Eco World can produce an impressive result for its FY14 which will end in Sep14. So far its FY14Q1 only produced PATAMI of RM0.8mil out of revenue of RM22.6mil, even though it has achieved sales of RM1.13bil in Mac14.

So I think it will take quite a number of years before it can reach the earning level of SP Setia which Mr Liew Kee Sin took decades to build.

Anyway, there will be a further 20% earning dilution in the future when the warrants are fully converted to mother shares.

Eco World & Tropicana, both are going for fast & furious growth, both has precious land at Macalister Road Penang and Canal City, which one do you think is better?

No comments:

Post a Comment