Koon Yew Yin: 25th Jan 2014

If you look at R Sawit 2011 annual report you will see that my family owned a total of 51.4 million shares which we bought at an average price of about 60 sen and sold when the price went above Rm 1.00.

If you look at SOP 2011 annual report you will see that my family owned 15,4 million shares which we bought at about Rm 3 in 2010 and we sold when the price went above Rm 6.

About 3 years ago when we bought SOP their palms were younger and I could foresee its profit growth prospect. For the same reason we are using our entire sale proceeds to buy Jaya Tiasa.

At present, we do not have any more R Sawit or SOP shares. I have also sold all my TSH and Ta An to buy JT. Readers do not need to tell me R Sawit, SOP, TSH or Ta An is better than JT.

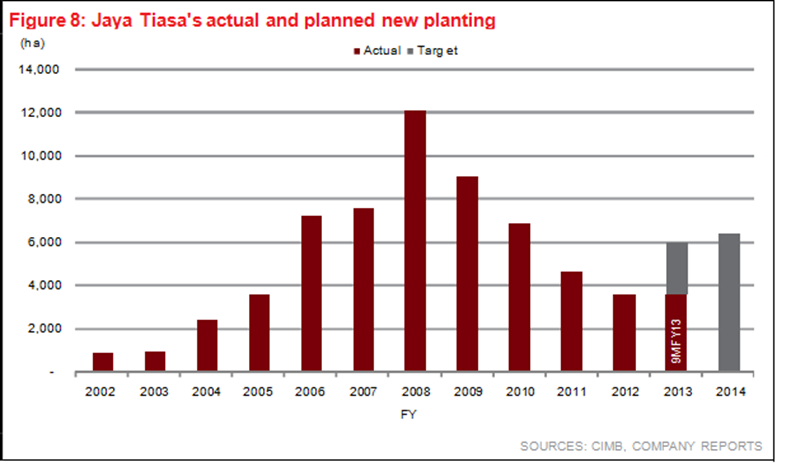

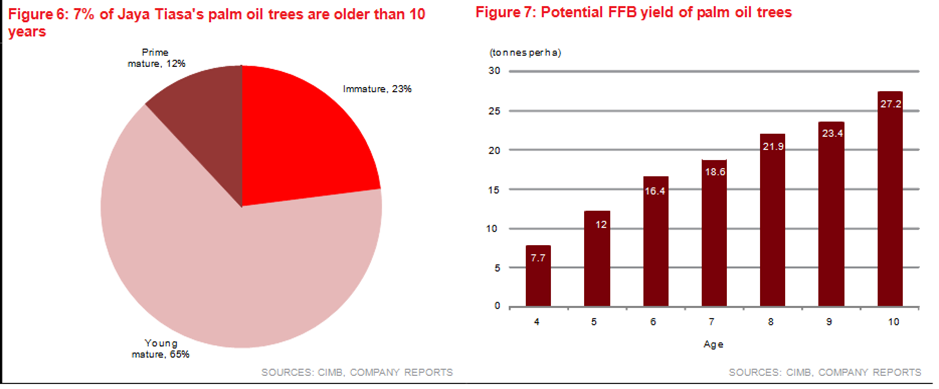

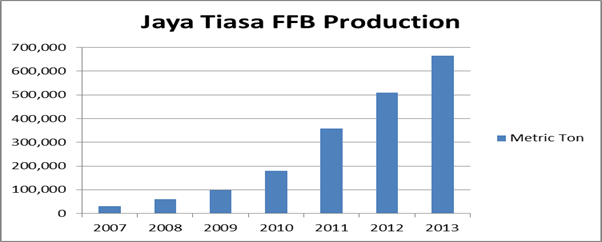

The price charts for R Sawit and SOP show that prices have appreciated while Jaya Tiasa share price has been depressed for a long time because it has not been showing much profit due to the young age of their palms. However, JT’s FFB production is projected to increase rapidly in the next few years as indicated by the FFB production chart.

On 18th Jan 2014, Alvin Tai, CFA from RHB research and I gave a talk on investment in the planation sector in Ipoh. About 120 people attended.

As all investors should know that the price of palm oil is the most important factor which affects the profit of all plantation companies. Alvin has calculation and charts to show that the current CPO price up trend will continue for the near future because Indonesia will have less palm oil for export. The reasons are:

A. Most of their palms are old and beyond their production peak.

B. Their economy is fast improving and people want to consume more palm oil.

C. There are more vehicles on the road and to reduce fossil fuel import, the Indonesian Government has mandated 10% use of biodiesel. As a result, 3 million tons of palm oil will be used to produce biodiesel. In 2012 Indonesia produced a total of 31 million tons of palm oil.

D. For the same reasons as in Indonesia, Malaysia is also mandating 10% use of biodiesel.

E. Due to population and economy increase of the whole world, more palm oil will be consumed.

Alvin considers Southern Acid and Jaya Tiasa are the best buys because SA is the cheapest among plantation shares and JT has the fastest increase of FFB production in the next few years and its share price has been depressed for a long time. You must bear in mind that famous companies like KLK, UP, SOP, TSH etc have been showing better earnings than JT before and they have been fully valued. They are no longer cheap. Moreover, their FFB production rate of increase will be slower relative to JT.

I am obliged to tell you that Jaya Tiasa is my major investment holding and I do not need you to buy to support its share price. If you decide to buy, you are buying it at your own risk. However, if you think that TSH, Ta AN, SOP, R Sawit are better, you do not need to tell me because I have already sold all of them to buy JT.

As I said before the most important share selection criterion is profit growth prospect and the faster the profit increases, the faster the share price will move up.

Koon Yew Yin